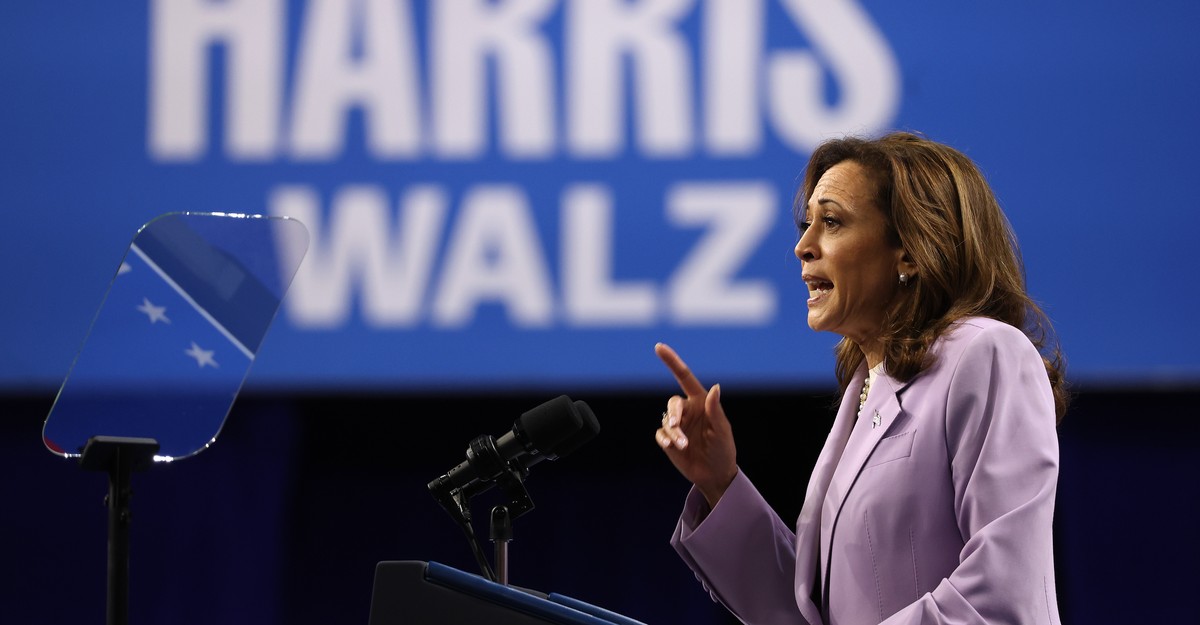

As Kamala Harris aligns herself with the policy proposal to eliminate taxes on tips, initially introduced by Donald Trump, she is strategically neutralizing any potential advantage her opponent may have gained from it. This move comes at little to no cost to her campaign, as she aims to stay competitive in the political sphere. By endorsing this concept, Harris is not only appealing to both sides of the political spectrum but also to a key demographic – the Culinary Union in Nevada, an electorally significant state. The Culinary Union, which had previously supported Harris, celebrated her backing of the proposal.

While the idea of eliminating taxes on tips may face challenges in implementation and enforcement, it presents a compelling narrative that resonates with many voters. Both candidates have recognized the popularity of this proposal and are striving to capitalize on its appeal to working Americans.

In a political landscape where every move is carefully calculated, Harris’s decision to support this policy seems to be a calculated risk with potential rewards. By aligning herself with this proposal, she not only challenges Trump’s narrative but also signals to voters that she is focused on their needs and concerns. As Harris prepares to unveil more detailed policy platforms in the coming weeks, her strategic maneuvers in the realm of economic policies will play a crucial role in shaping the outcome of the upcoming election.

**FAQs**

1. **What is the proposal to eliminate taxes on tips?**

– The proposal involves removing taxes on tips earned by workers, which has gained traction as a popular policy idea among both major political parties.

2. **How does Kamala Harris benefit from supporting this proposal?**

– By endorsing this policy, Harris neutralizes any advantage her opponent may have gained from it, appeals to a key demographic, and signals her focus on the needs of working Americans.

3. **Are there any challenges associated with implementing this proposal?**

– Economists have raised concerns about the feasibility and potential loss in federal revenue from the implementation of this policy. Additionally, passing and enforcing such a measure could prove to be challenging.

**Conclusion**

Kamala Harris’s decision to back the proposal to eliminate taxes on tips showcases her strategic approach to the upcoming election. By aligning herself with popular policy ideas and appealing to a broad base of voters, Harris aims to position herself as a candidate who understands the needs and concerns of the American electorate. As the campaign unfolds, her focus on economic policies and initiatives will continue to shape the narrative leading up to the election.